Bba 3rd Year Notes

Posted : admin On 12.08.2019BBA Books & Notes For All Semesters in PDF – 1st, 2nd, 3rd Year. BBA Stands for Bachelor of Bussiness Administration. Bachelor of Business Administration is a very popular Undergraduate Degree in India. Managerial as well as communication skills can be developed through BBA Course. Download BBA 1st year, 2nd year and Final year notes from below provided links.

BBA mantra is your One-Stop Search Engine for a variety of Notes related to Management Studies- Introduction to Financial Management Part 1

- Introduction to Financial Management Part 2

- Various Decision under Financial management

- Financial Planning

- Financial Markets

- Time Value of Money

- Profit Maximization Vs Shareholders Wealth Maximization

- Capital Budgeting

- Capital Structure

- Cost of Capital

- Leverage

- Dividend Decision

- Dividend Decision Models

- Working Capital Requirements

- Corporate Restructuring

- Long Term Sources of Finance

- Introduction to Advertising management

- Advertising Agency

- DAGMAR Approach

- Advertising Response Models

- Response Hierarchy Models

- FCB Grid Model

- Kim Lord Grid Model

- Elaboration Likelihood Model

- Advertising Appeals

- Advertising Copy

- Planning an Advertising Campaign

- Creative Strategy

- Advertising Budget

- Media Planning and Strategy Development

- Steps to Develop Media Plan

- Media – Types of Media

- Sales Promotion

- Recent Trends in Indian Advertising

- Introduction to HRM Part 1

- Introduction to HRM Part 2

- Challenges and Issues in HRM

- Human Resource Planning

- Job design & Techniques

- Job Analysis, Job Description, Job Specification

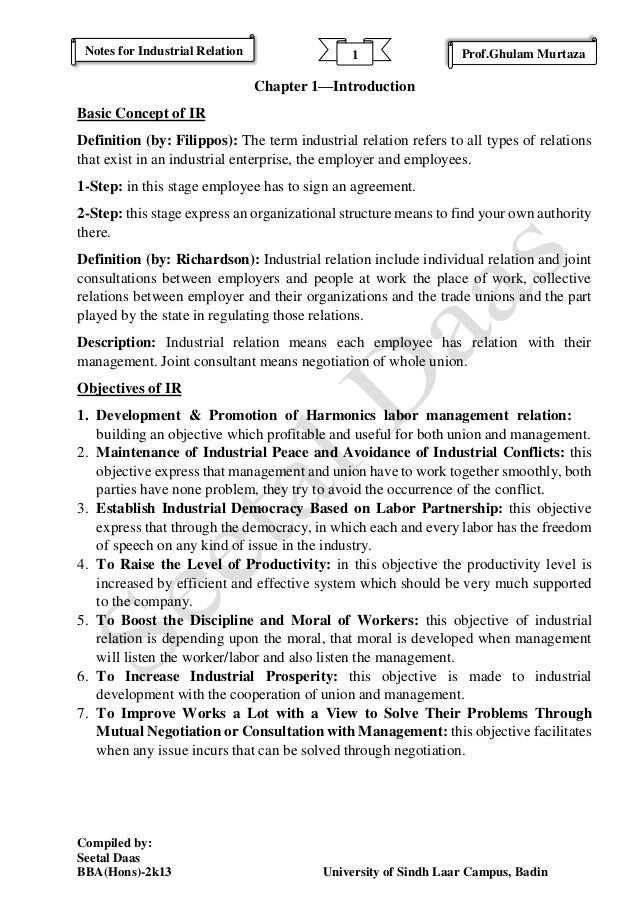

- Recruitment

- Selection

- Placement and Induction

- Promotion and Demotion

- Transfer & Employee Separations

- Training

- Incentives

- Discipline

- Grievance Handling

- Power

- Introduction to Company Law 2013

- Kinds of Companies

- Difference between Public and Private Company

- Doctrine of Ultra Vires

- Doctrine of Constructive Notice & Indoor Management

- Memorandum of Association

- Articles of Association

- Promoter

- Formation & Incorporation of a company

- Director

- Company Secretary

- Share Certificate Vs Share Warrant

- Bills of Exchange & its Types

- Promissory Note Vs Bills of Exchange

- Business Communication Introduction

- Principles of Communication

- Types of Communication

- Communication Barriers

- Oral Communication

- Listening

- Written communication

- Non-verbal Communication

- Formal & Informal Communication

- Communication Models – 1

- Communication Models – 2

- Self Development and Communication

- Group Discussion & Committee

- Reference Group

- Best place for Study Materials, Lectures and Notes of bba-bachelors of business administration courses, shared by various colleges and students for all.

- These Mathematics-XII FSc Part 2 (2nd year) Notes are according to “Punjab Text Book Board, Lahore”. Very helpful notes for the students of 2nd year to prepare their paper of Maths according to syllabus given by Federal Board of Intermediate and Secondary Education (FBISE), Faisalabad Board, Multan Board, Sargodha Board, DG Khan Board, Gujranwala Board, Rawalpindi Board or others board of Punjab, Pakistan.

- Introduction to Computer

- Hardware, Software & Storage Devices

- Computer Languages

- MS Word, Powerpoint & Excel

- Introduction to Information Systems

- E-commerce Vs E-business

- E-commerce

- E-commerce Models

- M-commerce

- Firewall

- Transaction Security

- Internet, Intranet, Extranet

- Introduction to Strategic Management

- Strategic Management Process

- Vision & Mission

- Objective Setting

- Environmental Scanning

- SWOT Analysis

- ETOP Analysis

- BCG Matrix

- ANSOFF Matrix

- Generic Business Strategies

- Strategic Choice

- Strategic Evaluation and Control

- Introduction to International Business

- Difference Between Domestic and International Business

- Modes of International Business

- Tariff & Non Tariff Barriers

- Regional Economic Integration

- International Market Intermediaries

- International Monetary Fund

- World Trade Organization

- World Bank

- Export Promotion Measures in India

- Multinational Corporations

- Consumer Behaviour Introduction

- Factors/Determinants influencing Consumer Behaviour

- Consumer Decision Making

- Consumer Behaviour Models

- Segmentation of Market

- Cultural & Social Factors Influencing Consumer Behaviour

- Family Influence on Consumer Behaviour

- Lifestyle Segmentation/Psychographics

- Attitude & Consumer Behaviour

- Personality & Consumer Behaviour

- Consumer Involvement and Motivation

- Ethics & Consumer Behaviour

- Perception

- Reference Group

- Lifestyle & Self-Concept

- Consumer Research

- Consumer Adoption

- Organizational Buying Behaviour

- Buying Centre and Buying Situation

- Organizational Decision Making

- Changing Consumer Behaviour in India

- Introduction to Business Environment

- Environmental Scanning

- SWOT Analysis

- ETOP Analysis

- BCG Matrix

- ANSOFF Matrix

- Social Responsibility of a Business

- Corporate Governance

- Consumerism

- Globalization

- Liberalization

- World Trade Organization

- International Monetary Fund

- World Bank

- Export Promotion Measures in India – FTZ, EPZ, SEZ

- Monetary Policy

- SEBI

- NBFC

- MNC

- Price Control

- Small Scale Industries

- Financial Service Introduction

- Financial Planning

- Financial Markets

- Lease Financing Introduction

- Types of Lease

- Leasing Process

- Factoring

- Factoring Process & Types

- Importance of Factoring

- Bills of Exchange & Types

- Indian Financial System Introduction

- Corporate Restructuring

- Non Banking Financial Company (NBFC)

- Introduction to Marketing Management

- Traditional & Modern Marketing Concepts

- Marketing Environment

- Marketing Mix – 4P`s

- Product

- Price

- Market Segmentation

- Market Targeting

- Market Positioning

- Market Research

- Marketing Budget

- Marketing Information System

- Sales Promotion

- Project management Introduction

- Generation and Screening of Project Idea

- Market and Demand Analysis of a Project

- Technical Analysis of a Project

- Cost of Project

- Cost of Production and Estimates of Sales & Production

- Working Capital Requirements of a Project

- Means of Finance

- Project Appraisal – Capital budgeting

- Prerequisites for Successful Project Implementation

- Introduction to Entrepreneurship

- ETOP Analysis, BCG Matrix

- Preparing a Business Plan

- Preparing a Marketing Plan

- Women Entrepreneurship

- Venture Capital

- Agricultural Marketing

- Small Scale Industries

- Industrial Sickness and Remedial Measures

- Introduction to Investment Analysis

- Investment Alternatives

- Securities

- Stock Market Indices

- Derivatives Market

- Risk

- Fundamental Analysis

- Technical Analysis

- Efficient Market Hypothesis

- Portfolio Construction

- Research Methodology Introduction

- Research Problem

- Methods for collecting Primary and Secondary Data

- Other Methods of Data Collection

- Questionnaire

- Sampling Theory

- Sampling Methods

- Introduction to E-commerce

- E-commerce vs E-business

- E-commerce Models

- Electronic Data Interchange – EDI

- Firewall

- Transactional Security

- M-commerce

- Internet, Intranet, Extranet

- Introduction to Marketing of Services

- Types of Services/Classification of Services

- Managing Service Quality

- GAP Analysis

- Flipkart Service Marketing Mix

- Tourism Service Marketing Mix

- Bank, Banking Introduction

- Indian Financial System

- Financial Markets

- Commercial Banks

- Credit Control by R.B.I.

- Securities

- Non Banking Financial Company

- Introduction to Management Accounting

- Classification of Costs

- Responsibility Accounting

- Zero based Budgeting

2015-08-20

The word Macro is derived from the Greek word 'makros' meaning large and thus macroeconomics is concerned with the activity in the large. The term macro-economics applies to the study of relations between broad economic aggregates such as total employment, the national product or income, the general price level of the economy etc. Therefore, the macroeconomics is also known as aggregate economics.Macroeconomics analyses and establishes the functional relationship between the said large aggregates. Macroeconomics deals with the functioning of the economy as a whole, including how the economy's total output of goods and services and its total employment of resources are determined and what causes these totals to fluctuate.

Macroeconomics is concerned with the behavior of the economy as a whole with boom and recessions, the economy's total output of goods and services and the growth of output, the rates of inflation and unemployment, the balance of payments, and exchange rates. Macroeconomics deals both with long-run economic growth and with the short-run fluctuations that constitute the business cycle.

Macroeconomics focuses on the economic behavior and policies that affect consumption and investment, the trade balance, the determinants of changes in wages and prices, monetary and fiscal policies, the money stock, the government budget, interest rates, and the national debt.

In brief, macroeconomics deals with the major economic issues and problems of the day. To understand these issues, we have to reduce the complicated details of the economy to manageable essentials. Those essentials lie in the interactions among the goods, labour, and assets markets of the economy, and in the interactions among national economies whose residents trade with each other.

It seeks the answer of questions like: why the unemployment rate increased from 5 % to 15%? Why the price level increased? Why the growth rate of national income is declining?

A.Issues of Macroeconomics

Basically, there are three issues of macroeconomics. These issues are tried to capture under the following questions:

a. Why do output and employment falls and how can unemployment be reduced?

From time to time many countries of this world experience high unemployment that persists for long periods. Macroeconomics examines the sources of such persistent unemployment and suggests the possible remedial measures.

There are many theories of why persistent high unemployment is possible. There is also the policy question of what should be done about unemployment. Basically, two different policies to reduce this high and persistent unemployment are suggested by different group of economist. Some say the government should put in place appropriate unemployment compensation schemes but ought to not otherwise undertake any special policies such as tax cuts to deal with unemployment.Others argue that the government should pursue an active fiscal policy, for instance, by cutting taxes and/or raising government spending when unemployment is high so as to create demand and hence jobs.

b. What are the sources of inflation, and how can it be kept under control?

A market economy uses prices as a yardstick to measure economic values and as a way to conduct business. During rapidly increasing prices (period of hyperinflation) the yard stick looses its values. Rapid price changes lead to economic inefficiency. Thus, macroeconomic policy have emphasized price stability as the central goal. To maintain the price stability and to reduce the hyperinflation without causing recession, economist suggest the various policies. Some economist argued that monetary policies are best however, others argued that the fiscal and exchange rate policies are also equally important. Therefore, to solve this issue macroeconomics may suggest the proper role of monetary, fiscal and of exchange rate policies.

c. How can a nation increase its rate of economic growth?

Bba 1st Semester Notes Pdf

Above all macroeconomics is concerned with long run prosperity of a country. The growth of a nation's productive potential is the central factor in determining the growth in real income and living standard. Every nation wants to know the ingredients to achieve persistent and higher economic growth. To secured the higher economic growth, some economist suggest the active government policies (role) in the area of infrastructure and technology, deficit budgets, industrial policies, investment in human development and in research and development, however, others argue that government interference should be minimum. Who is right? Macroeconomics tries to answer this question.

The questions of whether the government can and should do something about each of these issues and what is best to do have been at the center of macroeconomics for a long time. The three leading issues mentioned above certainly do not exhaust the debate. There are, for example, questions about economic policies: Should government fix the exchange rate or it should be flexible or market determined? Which one is best and why?

To recommend the solution of above stated prominent macroeconomic issues, economists are divided in to the two broad school of thought. One school of thought believes that markets work best if left to themselves; the other believes that government intervention can significantly improve the operation of the economy. These are outlined in the following paragraph.

In the 1960s, the debate on these question involved Monetarist, led by Milton Friedman, on one side, and Keynesians, including Franco Modigliani and James Tobin, on the other. In 1970s, the debate on much the same issues brought to the fore (front) a new group – The New Classical Macroeconomists, who are against the active government role or policies to improve the economic performance. On the other side emerged in the 1980s are – The New Keynesians Macroeconomists, who believe on the active government policies or role in improving the performance of economy.

B.The Subject Matter of Macroeconomics

a. Analysis of determination of national income and employment.

Though there were some pre-Keynesian theories with macro nature like business cycle and the general price level it was the J.M. Keynes who gave importance on macro-economic analysis and developed a general theory of income and employment in his book entitled, 'A General Theory of Employment Interest and Money', published in 1936. Keynes showed that how the equilibrium level of national income and employment was determined by aggregate demand and aggregate supply. He also showed that there will be involuntary unemployment at the equilibrium level, against the classical concept of full employment.Keynesian macro-economic model revealed how consumption function, investment function, liquidity preference function interact to determine income, employment, interest and general price level. To understand the equilibrium level of income and employment it is necessary to know the determinants of consumption function and investment function. Thus, the analysis of consumption function and investment function are the important subject matter of macroeconomic theory.

b.Theory of general price level and inflation

Macroeconomics also concerns about the determination of general price level. Keynes showed that involuntary unemployment and depression are due to the deficiency of aggregate demand and inflation was due to the excessive aggregate demand. Theory of inflation is one of the components of macroeconomic theory and which is very much important for the developed as well as developing countries. Macroeconomic theory deals with the causes and consequences of business cycle i.e. inflation and deflation and it also explains about the policy instruments to cure such inflationary as well as deflationary trends in the economy.

c. The theory of economic growth

Another important branch of macroeconomics is the theory of economic growth. In short it is also called as growth economics. Virtually the problem of growth is a long run phenomenon and Keynes did not considered the long run economic problem. Later economists like Harrod and Domar developed the long run growth models extending the concept of Keynes. According to them investment adds productive capacity (i.e. capital stock) as such to achieve growth investment must be increased. The Harrod-Domar growth model shows required rate of growth of income to achieve the steady growth in the economy. Growth theories have been further developed and extended these days. Growth theories are important to both developed and developing countries. However, the special growth theories relating to developing countries are generally known as economics of development. All these development theories are the subject matter of macroeconomics.

d. Relative share of national income

Another important subject matter of macroeconomics is to explain about the determinants of relative shares from the total national income to various segments of the society. Economists show that relative shares of wages and profits in the national income depend upon the propensity to consume and the rate of investment in the economy.

II.Basic Economic Problems Issue: Resource Scarcity and Efficiency

Over the last 30 years the study of economics has extended to include a vast range of topics. Therefore, economics can be defined in the different ways. The major definitions of economics are:

1.It studies how the price of labour, capital, and land are set in the economy, and how these prices are used to allocate resources.

2.It explores the behavior of the financial markets, and analyzes how they allocate capital to the rest of the economy.

3.It examine the distribution of income, and suggests ways that the poor can be helped without harming the performance of the economy.

4.It looks at the impact of government spending, taxes, and budget deficits on growth.

5.It studies the swings in unemployment and production that make up the business cycle, and develops government policies for improving economic growth.

6.It examines the patterns of trade among nations, and analyze the impacts of trade barriers.

7.It looks at growth in developing countries, and propose ways to encourage the efficient use of resources.

On the basis of these definitions of economics we can conclude that: 'Economics is the study of how societies use scarce resources to produce valuable commodities and distribute them among different people.' From this definition of economics it is clear that the desires of the people are unlimited but to fulfill these desires resources are limited (scarce) or means are limited to fulfill the unlimited ends of the people. Therefore, to fulfill these unlimited ends by using the limited means (scarce resource) we should use the resource efficiently in the one hand and go for choice in the other.

Economic theory enunciates the laws and principles which govern the functioning of an economy and its various paths. As we discussed under microeconomics an economy exists because of two basic facts. First, human wants for goods and services are unlimited. Second, the productive resources with which to produce goods and services are scarce or limited. Because of unlimited wants and limited resources we cannot satisfy all our wants or desire. Thus a society has to decide how to use its scarce resources efficiently so that maximum social welfare could be attained. Resources being scarce, it is highly desirable that they should be most efficiently used. Thus, it is necessary to know whether a particular economy works efficiently. It is also desirable to know whether the production and distribution of national product decided by an economy is efficient. The production is said to be efficient if the productive resources are utilized in such a way that through any re-allocation it is impossible to produce more of one good without reducing the output of any other good. The production would be inefficient if it is possible by rearranging the allocation of resources to increase the production of one good without reducing the output of any other. Likewise, the distribution of the national product is efficient if it is impossible to make, through any redistribution of goods, some individuals or any one person better off (more satisfied) without making at least one other person worse off (less satisfied).

III.The Economic Organization: Market, Command and Mixed Economies

Every human society – whether it is an advanced industrial nation, a centrally planned economy or an isolated trible nation – must confront and resolve three fundamental economic problems. Every society must have a way of determining what commodities are produced, how these goods are made, and for whom they are produced. These three fundamental questions of economic organizations – what, how and for whom – are equally important in today's world as they were at the beginning of civilization. Different societies are organized through alternative economic system.

Ba 3rd Year Notes

What are the different ways that a society can answer the questions of what, how and for whom ? Different societies are organized through alternative economic systems. Depending upon the economic system they follow they will adapt different ways to answer these questions. Economics studies the various mechanisms that a society can use to allocate its scarce resources.

Economists generally distinguish two fundamentally different ways of organizing an economy. At one extreme government makes most economic decisions at the top and gives economic command to the down ladder. Such economy is called as command economy. On the other hand all the economic decisions are made in markets, where individuals or enterprises voluntarily agree to exchange goods and services, usually through payments of money. Such economy is called market economy.

A command economy is one in which the government makes all important decisions about production and distribution. Almost all the means of production are owned by the government under command economy. The government also owns and directs the operations of enterprises in most industries; it is the employer of most workers and shows the ways to find the job and it decides how the output of the society is to be divided among different goods and services. In short, in a command economy, the government answers the major economic questions through its ownership of resources and its power to enforce decisions.

A market economy is one in which individuals and private firms make the major decisions about consumption and production. A system of prices, markets, profits and losses of incentives and rewards determines what, how and for whom. Firms produce the commodities that yield the highest profits by the technique of production that are least costly. Consumption is determined by individuals' decisions about how to spend their incomes. The extreme case of a market economy, in which, the government keeps its hands off economic decisions, is called a laissez-fair economy.

None of the present world societies fall under these two extreme categories. Rather all societies are following the mixed economies which is the blending of market economy and command economy. In countries like Britain and USA where the most of the economic decisions are made in the market place still the government plays an important role in regulating the functioning of market. In the same way in command economies also the role of market is increasing.

Many countries in the world are following mixed economies where the government as well as markets are functioning simultaneously to answer the basic economic questions like what, how and for whom.

IV.Objectives of Macroeconomics

In general macroeconomic performance will be judged by looking few key macroeconomic variables such as the growth rate of output (GDP), the unemployment rate and the rate of inflation. In other words the performance of macroeconomics is judged with the growth rate of GDP, low unemployment and price stability.

A.Gross Domestic Product (GDP)

The ultimate goal of economic activity is to provide the goods and services that the society desires. The most comprehensive measure of the total output in an economy is the measure of Gross Domestic Product (GDP). GDP is the measure of market value of all final goods and services produced in a economic territory with in a given time period (during a year). There are two ways to measure GDP. These are:

Nominal GDP. It is measured in actual market prices or current year price of goods and services. Nominal GDP measures the value of the economy's total output, at the prices prevailing in the period during wich the output is produced.

Real GDP. It is measured in constant prices or base year price of goods and services. Real GDP measures the total output produced in any one period at the prices of some base year. Real GDP, which values the output produced in different years at the same prices, implies an estimate of the real or physical change in production or output between any specified years.

Movements in real GDP are the best available measure of the level and growth of output. Therefore, the rate of change in real GDP is defined as the economic growth. Developed economies generally exhibit a steady long-term growth in real GDP and improvement in living standards.

There are two fundamental reasons behind the change in real GDP. These are :

- Available amount of resources in the economy changes.

- The changes in efficiency of factors of production such as labor and machineries.

The maximum possible GDP with the available resources is known as potential GDP. It represents the maximum amount the economy can produce while maintaining reasonable price stability. Potential output is also called as high-employment level of output. When an economy is operating at its potential, unemployment is low and production is high. Potential output is determined by the economy's productive capacity, which itself depends upon the inputs available and the economy's technological efficiency.

B.Higher Level of Employment

Among the macroeconomic indicators the people within the economy most directly feel employment and unemployment situations. People always want to find high paying jobs without much difficulty. They also want job security and more benefits from their current job. These are the objectives of higher level of employment in macroeconomics terms. The unemployment rate shows the state of business cycle. When output is falling the demand for labor falls and the unemployment rate rises. Unemployment is the most serious problem of any economy. Thus, one of the objective of macroeconomics is to attain the higher level of employment or low unemployment within the economy. During the great depression of 1930s there was a high unemployment and the concept of classical economy that the market forces operate automatically and correct the problem was failed. Keynes explained that by increasing the aggregate demand the unemployment situation could be tackled.

C.Price Stability

The third macroeconomic objective is to maintain stable prices. To understand this goal it is necessary to know about the measuring process of price trend. The most common measure of the overall price level is the Consumer Price Index (CPI). The CPI measures the cost of a fixed basket of goods (including items such as food, shelter, clothing and medical care) bought by the average urban consumer. The overall price level is denoted by the letter 'P'.

The sustained and persistent change in the average price level is called the rate of inflation. The rate of inflation denotes the rate of growth or decline of the price level from one year to next year.

A deflation occurs when prices decline (which indicates the negative inflation). Price stability is more important among the objectives of macroeconomics since it helps to increase output and employment. History shows that rapid prices changes distort the economic decisions of companies and individuals. Slowly rising price level is desirable since it helps for the investment and expanding economic activity. Which may increase employment. Thus, most nations want a gentle upward creep of prices as the best way of allowing the price system to function efficiently.

Countries are facing the problem of increasing unemployment, decreasing the rate GDP growth and high rate of inflation. In these situation market forces only could not attain the objectives of macroeconomics. For this the role of government is equally important and have certain policy instruments to affect macroeconomic activities. Broadly such policy instruments are divided into two groups, which are Fiscal, Monetary and Other (Exchange Rate) Policy.

A. Fiscal policy

Broadly there are two main components of fiscal policy they are government spending and taxation. Government spending comes in the form of purchases of goods and services, construction of infrastructure, purchases of arms and ammunitions for maintaining peace and security, for transfer payments (old age pensions, unemployment pensions, widow pensions etc). Such government spending determines the relative size of public and private sectors. Government spending also affects the overall level of spending in the economy and thereby influence the level of GDP and employment.

The other part of the fiscal policy is taxation. Taxation affects the economy in two ways. Tax affects people's income. It either increases or decreases disposable income thus affects the private consumption expenditure as well as savings. Such private consumption and savings have important effects on output and investment in the short and long run. Taxes may also affect prices of goods and factor of production and thereby affects incentives and behavior. High profit tax may discourage investment etc. In addition, taxes affect the price of goods and factors of production and there by affect incentives and behavior.

B. Monetary Policy

The second major instrument of macroeconomic policy is monetary policy. Under the monetary policy government manages money, credit and banking system. Mostly the monetary policy is handled by the central bank of each country. Central bank follows the policy either to reduce or increase the supply of money and tries to solve the economic problem within the country.

Under this policy government use the appropriate exchange rate policy (such as fixed, flexible or paged exchange rate policy) to attained the macroeconomic objectives.

All the detail on fiscal and monetary policy will be discussed under the relevant heading.

VI.The Business Cycle and Output Gap

Inflation, growth, and unemployment are related through the business cycle.The business cycle is the more or less regular pattern of expansion (recovery) and contraction (recession) in economic activity around the path of trend growth.At a cyclical peak, economic activity is high relative to trend; at a cyclical trough the low point in economic activity is reached. Inflation, growth and unemployment all have clear cyclical patterns. However, we concentrate on measuring the behavior of output or real GDP relative to trend in the study of business cycle. The trend or trend path of GDP is the pathGDP would take if factors of production were fully employed.

Output is not always at its trend level, that is, the level corresponding to full employment of the factors of production. Rather output fluctuates around the trend level. That fluctuation in output create the business cycle. The business cycle have four phases, which are explained in the following paragraphs.

A.Prosperity

C.Depression

The prosperity phase of the cycle is the most desirable and is the goal of national economic policies. during this phase the optimum level of economic activity is achieved and factors of production are fully employed. There is no involuntary unemployment in this phase.

In the prosperity phase, demand, output, employment and income are at a high level. They tend to rise prices. But wages, salaries, interest rates, rents and taxes do not rise in proportion to the rise in prices. The gap between prices and costs increases the margin of profit. The increase of profit and the prospect of its continuance commonly cause a rapid rise in stock market values. 'All securities including bonds rise under the influence of improving exceptions. The outstanding change is in stocks that reflecting the capitalized values prospective earning register in an exaggerated from rise the profits of enterprise.' The economy is engulfed in waves optimism. Larger profit expectations further increase investment which is helped by liberal bank credit. Such investments are mostly in fixed capital, plant, equipment and machinery. They lead to considerable expansion in economic activity by increasing the demand for consumer goods and further rising the price level. This encourage retailers, wholesalers and manufactures to aid inventories. In this way, the expansionary process becomes cumulative and self-reinforcing until the economy reaches a very high level of production, known as the peak or boom.

The peak or prosperity may lead the economy to full employment and to inflationary rise in prices. It is a symptom of the end of the prosperity phase and the beginning of the recession. The seeds of recession are contained in the boom in the form of strains in the economic structure which act as brakes to the expansionary path. They are:

1.scarcities of labor, raw materials etc., leading to rise in costs relative to prices,

2.rise in the rate of interest due to scarcity of capital, and

3.failure of consumption to rise due to rising prices and stable propensity to consume when incomes increase.

The second makes investments costly and along with the first lowers business expectations. The third factor leads to the piling up of inventories indicating that sales or consumption log behind production. These forces become cumulative and self-reinforcing. Entrepreneurs, businessmen and traders become over cautions and over optimism gives way to pessimism. This is the beginning of the upper turning point.

B.Recession

Recession starts when there is a downward descend from the 'peak' which is of a short duration. It marks the turning period during which the forces that make for contraction finally win over the forces of expansion. Its outward signs are liquidation in the stock market strain in the banking system and some liquidation of bank loans, and the beginning of the decline of prices.' As a result, profit margins decline further because costs start overtaking prices. Some firms close down. Other reduce production and try to sell out accumulated stocks.Investment, employment, incomes and demand decline. This process becomes cumulative.

Recession may be mild or severe. The latter might lead to a sudden explosive situation emanating from the banking system or the stock exchange, and a panic or crisis occurs. 'When a crisis, and more particularly a panic, does occur, it seems to be associated with a collapse of confidence and sudden demands for liquidity. This crisis of nerves may itself be occasioned by some spectacular and unexpected failure. A firm or a bank, or a corporation announces its inability to meet its debts. This announcement weakens other firms and banks at a time when ominous signs of distress are appearing in the economic structure, moreover, it sets off a wave of fright that culminates in a general run on financial institution. Such was the experience of the United States in 1373, in 1893 and in 1907.'

C.Depression

Depression phase of the cycle is characterized by low output and unemployment of factors of production in the economy.

Recession merges into depression when there is a general decline in economic activity. There is considerable reduction in the production of goods and services, employment, income, demand and prices. The general decline in economic activity leads to a fall in bank deposits. Credit expansion stops because the business community is not willing to borrow. Bank rate falls considerably. This fall in active purchasing power is the fundamental background of the fall in prices. That, despite the general reduction of output, characterized by mass unemployment general fall in prices, profits, wages, interest rate, consumption, expenditure, investment, bank deposits and loans, factories closedown, and construction of all types of capital goods, building, etc. comes to a standstill. These forces are cumulative and self-reinforcing and the economy is at the trough.

The trough or depression may be short-lived or it may continue at the bottom for considerable time. But sooner or later limiting forces are set in motion, which ultimately tend to bring the contraction phase of end and pave the way for the revival. A cycle is thus complete.

D.Recovery

The depression phase of the cycle is followed by recovery phase. In this phase employment and output slowly begin to rise. The real income of all factor owners also slowly increases.

The behavior of a business cycle is difficult to determine because of the multitudinous factors and circumstances that lie behind cyclical fluctuations. Attempts to explain them have brought forth a large number of theories. Some attribute cycles to exogenous causes and others to endogenous causes. Some economists classify business cycle theories in to monetary and non-monetary theories, while others classify them into real psychological, monetary and those relating to variations in spending, saving and investment. These phases of business cycle are shown in the Figure I -1.

This cyclical fluctuation exist due to the changes in real GDP. The change in real GDP will occur due to the following two reasons.

- When more resources become available: the size of the population will increases, firms acquire machinery or build plants, land is improved for cultivation, the stock of knowledge increases as new goods and new methods of production are invented and introduced. This increased availability of resources allows the economy to produce more goods and services, resulting in a rising trend level of output.

- Factors are not fully employed all the time. Full employment offactors of production is an economic, not a physical, concept. Physically, labor is fully employed if everyone is working 16 hours per day all the year. In economic terms, there is full employment of labor when everyone who wants a job can find one within a reasonable amount of time. Because the economic definition is not precise, we typically define full employment of labor by some convention, for example, that labor is fully employed when the unemployment rate is 5.5 percent. Capital similarly is never fully employed in a physical sense; for example, office buildings or lecture rooms, which are part of the capital stock, are used only part of the day. When the labor and capital are fully employed or there rate of employment will increase output will increase.

The output gap measures the gap between actual output and the output the economy could produce at full employment given the existing resource.

Full – employment output is also called potential output. The output gap allows us to measure the size of the cyclical deviations of output from potential output or trend output. In Figure I – 2 the shaded area represents the output gap.

Therefore, Output Gap= Potential Output – Actual output.

Figure I – 2: Output Gap, Potential and Actual Output (GDP).

VII.Society's Technological Possibilities

Every economy has limited stock of productive resources - labor, technical knowledge, factories, and tools, land energy. To decide what and how things should be produced, the economy is in reality have to decide how to allocate its resources among different possible goods and services. As an individual the economy's need are also unlimited relative to its resources. Thus an economy must decide how to fulfill the unlimited need of the society with its limited productive resources. It must choose among different potential bundles of goods (what), select from different techniques of production (how) and decide in the end who will consume the goods (for whom).

A.Inputs and Outputs

To answer the question of What? How? and for Whom? every society make choices about the economy's inputs and outputs. An economy uses its existing technology to combine inputs to produce outputs. Outputs are the various useful goods or services that result from production process and are either consumed or employed in further production. We also use the term factor of production to denote input. Such inputs or factor of production can broadly classified into three i.e. land, labor and capital.

Land. Broadly land is a natural resources and is the gift of nature to productive processes. It includes land used for farming, factories, houses and roads. The energy resources (oil), and the non energy resources (metal from mining) available within the earth are also comes under the land. The environmental resource such as clean air and pure drinking water are also included under the land input.

Labor. Labor consists of the human time spent in production. It is the most familiar and most crucial input for an advanced industrial economy.

Capital. Capital resources form the durable goods of an economy, produced in order to produce other goods. They include machines, automobiles, buildings, trucks, etc.

Thus, a society, with limited inputs and unlimited need, must decide:

1.what outputs to produce and in what quantity,

2.how to produce them - i.e. by what techniques inputs should be combined to produce the desired outputs, and

B.Value Added

While calculating national income through final product approach, the market value of only final goods and services is taken into account. The term value added simply indicates the value addition in the goods in the process of production. This is one of the way to avoid double counting. But it is difficult to distinguish properly between a final product and an intermediate product. For example raw materials, semi-finished products, fuel and services etc. are sold as inputs by one industry to the other. They may be final goods for one industry and intermediate for others. So to avoid duplication the value of intermediate product used in manufacturing final products must be subtracted from the value of total output of each industry in the economy. If the value of intermediate goods is also considered it will result in the problem of double counting. Double counting means that certain items are counted more than once while calculating national income. Double counting, thus, leads to overestimation of national income. In order to avoid double counting, only the value of final products should be included in national income, while the value of intermediate goods should not be considered. For example; bread is the final good. While wheat and flour are intermediate goods. The price of bread already incorporate the costs of wheat and flour because these costs have been paid during the production process. Thus, while calculating national income, separate inclusion of the value of wheat and flour along with the value of final goods bread will lead to double counting and this should be avoided.

In order to calculate the value added at a particular state of production, the cost of intermediate products is deducted from total value of output. An example of value added is shown in the Table I – 1.

Thus, Value Added= Value of Output - Cost of Intermediate Goods.

The calculation of value added is illustrated through an example given in Table I - 1. In this example there are three producing units, i.e. farmer, miller and baker. The farmer produces wheat without incurring any cost and sells the same to the miller for Rs. 500 Thus, the value added by the farmer is equal to the value of his output, i.e. Rs. 500. The miller converts wheat into flour and it for Rs. 700 to the baker. The value added by the miler, therefore, is equal to the value of output, minus the cost of intermediate goods. i.e. Rs. 700 - Rs. 500 = Rs. 200. The baker makes bread with flour and sells it to the consumers for Rs. 1000. Accordingly, the value added by the baker is Rs. 1000 - Rs. 700 = Rs. 300.

Table I - 1 : Estimation of Value Added

Producer | Value of Output | Gross Value Added |

Wheat | – | |

Miller | 700 | 200 |

Bread | 700 | |

Total | 1200 | |

by the farmer = Rs. 500 - zero =Rs. 500

by the Baker = Rs. 1000 - 700 =Rs. 300

Thus, the difference between the value of material outputs and inputs as each stage of production is called the value added. If all such differences are added up for all industries in the economy, we arrive at the GNP by value added.

C.The Production Possibility Frontier

We can show the society's technological possibilities with the helpof production possibility frontier. Societies cannot have everything they want. They have limitation of resources and the technology available to them. If you spent more in one sector less will remain for another sector to spend for the government. e.g. military expanses vs. social services or infrastructure.

The Production Possibility Frontier (PPF) shows the maximum amounts of production that can be obtained by an economy, given its technological knowledge and quantity of inputs available. The PPF represents the menu of goods and services available to society.

Let us consider an economy that will produce only two goods i.e. guns and butter. Gun representing the good for defense and butter representing the social good. With the total resources available within the country and utilization of existing technology, let us suppose that the country can produce the maximum quantity equal to 5000 guns of certain kinds and 10000 m.ton butter. There may be many other possibilities in between these two extreme case. If we are willing to give up some butter, we can have some guns. If we are willing to give up still more butter, we can have still more guns.

A schedule of possibilities is given in Table I –2. Combination F shows the extreme where all butter and no gun are produced, while A depicts the opposite extreme where all resources go into guns. In between – at E,D,C, and B – increasing amounts of butter are given up in return for more guns.

Table I -2:Alternative Production Possibilities.

Possibilities | Guns (Thousands) |

0 | |

B | 4 |

4 | |

D | 2 |

8 | |

F | 0 |

Source: Hypothetical Example.

We can represent the production possibilities of Table I -2 more vividly in the Figure I –3. This diagram measures butter along the horizontal axis and gun along the vertical axis. Various production possibilities such as A, B, C, D, E, and F are shown in the Figure I -3. If we join all of these combinations by a curve we get the PPF.

Figure I -3: The Production – Possibility Frontier.

PPF shows the different situation and choices of the society. An increase in inputs, or improved technological knowledge, enables a country to produce more of all goods and services and PPF may shift upward.

There is also choice between current consumption and investment for capital goods for future consumption. By sacrificing current consumption and producing more capital goods a nation's economy can grow more rapidly making possible more of goods in the future.

D.Opportunity Cost

Society must make choices since resources are scarce. Life is thus full of choice. In the world of scarcity, choosing one thing means giving up of otherthing of our consumption bundle. The opportunity cost of a decision is the value of the good or service forgone. In many decisions government has to choose one for another. While choosing one the output or services from other is loosed. Such loosed output or services is called opportunity cost for the utilization of resources for present use.

Such opportunity cost can be illustrated with the help of PPF. Moving from one point to another in PPF there is trade off between two goods. That shows the opportunity cost of one good in terms of other. Examining the PPF in Figure I -3, which shows the tradeoff between guns and butter. Suppose the country decides to increase its gun purchase from 2000 guns at D to 3000 guns at C. This decision incur the opportunity cost. The opportunity cost of moving from D to C is the butter that must be given up to produce the extra guns. In this example the opportunity cost of the 1000 extra guns is Rs. 200,000 if the price of butter is Rs. 100,000 per m. ton.

VIII.Stocks and Flows

The twin concept of stocks and flows both are variables. They are the quantities that may grow smaller or larger over time. The difference between them is that a stock is a quantity measurable at a specified point in time and the flow is a quantity that can be measured only in terms of a specified period of time.

For example a gauge may indicate that the stock of water in a reservoir is 50 million gallons. Here the stock variable is 50 million gallons at a particular point of time. It would be meaningless to describe this as 50 million gallons a year, a month, a week, or a day. On the other hand another gauge may indicate that the flow of water into the reservoir amounted to 365 million gallons over the year then ended. Assuming that the flow was at a fixed rate over the year, this reading also indicate that water had flowed in at a rate of 7 million gallons per week or 1 million gallons per day.

Total number of persons employed in a country is the stock variable. On the other hand the number of persons who secure new jobs or leave of employment are flow variables. Total number of employed people is 1 million at a point in time (at particular day). It would be nonsense to say that the number of employed is 1 million per year.

Money is a stock, but the spending of money is a flow. The amount of money can be expressed for a particular point of time whereas the spending will be expressed for a period of time. Change in the variable always comes under flow since it is measured under the given time period.

The macro flow concepts include the national income, output, consumption investment, saving, wages, interest, profit , etc; while the macro stock concepts include total money supply, total bank deposits, wealth, inventories, capital stock, debts, etc. There are certain macroeconomic variables which have both the flow and stock magnitudes. For example, money supply is a stock while the changes in money supply are a flow magnitude. Certain other variables like wages, dividends, social security and tax payments and the like are only flow quantities and have no stock counterpart. Similarly, income is a flow, wealth a stock concept.

(Note: In addition to stock and flow variables, there are some other macroeconomic variables such as endogenous, exogenous and ratio variables. Interested students can study these concepts from macroeconomics book.)

IX. Black or Underground Economy

During recent years, in many countries of the world, there has been a tremendous growth of activities that are not reported to the government. Such activities are called underground economy or black economy. Such activities include the activities like gambling, prostitution, drug dealing, smuggling of foreign currency, work done by illegal immigrants in developed countries, smuggling of commodities etc. Such activities are found due to the stringent government regulation and high taxes. Thus, such activities are motivated by the desire to reduce taxes or avoid government control or sanctions.

Not all-underground activity is properly a part of GDP. In general, national accounts exclude illegal activities from national output since these are 'bads' and not 'goods'. e.g. heroin trade, trade of green grass, etc.

But there are some activities, which are legal but not reported to the government. Such activities will be estimated with certain reasoning. However, care should be taken while estimating such underground economy. (Note: For detail see page: 34 – 35 of Macro economics, Sixth Edition, Rudiger Dornbusch & Stanley Fischer).

In order to explain the behavior of individual consumer, producer or industry or of the economy as a whole the economists have constructed analytical models. An economic model usually consists of a set of equations that express relationships between variables that are relevant for the problems to be investigated. Such equation attempts to explain the behavior of one variable i.e. it seeks to establish cause and effect relationship in respect of an individual variable. There is a mutual relationship among various variables, i.e. a variable influences the other variables and in turn is influenced by them. For example, consumption depends upon income and consumption being an important part of aggregate demand influences income. In such situation values of various variables are to be determined simultaneously. Therefore models, which involve more than one equation, attempt to solve these equations simultaneously.

A model is an abstraction from reality. It only represents main significant features. In order to build model we should make many assumptions to simplify it. Thus, in this complex and real economic world, economic problems could not be explained with the help of the model. Some useful and meaningful features of economic world are extracted under the model.

With all these difficulties, economic models are still used by economists frequently. Mainly economic models are used for the purpose of analysis and prediction. By analysis we mean how adequately we can explain the behavior of an economic agent, that is, consumer, producer or the economic system as a whole. From a set of assumptions we derive through deductive logic certain laws, which describe general application. On the other hand, prediction implies the ability of a model to forecast the effect of changes in some magnitudes in the economy. For instance, a model of price determination through demand and supply is generally used to forecast the effect of imposition of an excise duty or sales tax on the price of a commodity.

The most important attribute of a model depends on its purpose, i.e. whether the model builder wants to use it for predicting the effect of a change in some variable or for analyzing and explaining the particular behavior of an economic agent.

Economic models may be used to explain both micro as well as macroeconomic variables. Under microeconomics we discussed the relationship of quantity demanded and supplied with price. i.e. Qd =a - bP and Qs = c + dP

Where Qd and Qs are quantity demanded and supplied, a, b, c, and d are parameters and P denotes price.

Equilibrium price could be calculated at the equality of demand and supply equation.

A.Keynesian Macroeconomic Model

According to Keynes national income is determined by the level of aggregate demand. The following are the equations of Keynesian model:

C = Consumption

Y = National income and

a & c are parameters. c represent the marginal propensity to consume and a represents autonomous consumption when income is zero. If we sole all the equations of the model for Y we get the equilibrium level of income and output.

Take simple example to determine the equilibrium level of income

C = 20 + 0.75 Y

Y = C + I

Substituting the value of C and I in Y = C + I, we get

Y = 20 + 0.75 Y + 25

Solving for Y, we get

Y = 180

B.Endogenous and Exogenous Variables in Economic Models

Motivation Notes Bba 1st

The variables whose value is determined within the system or model are endogenous variables and the variable is exogenous whose value is determined outside the model. For example in a demand and supply equation the value of P and Q both are interrelated. The value of one depends on the value of other and the value of them are determined within the model. Thus, the P and Q both are endogenous variables.

In case of agricultural production, supply of an output depends upon the prices of the product (P) and rain fall (R). One of the way of expressing the relationship among these variables is:

Qs = a +bP + cR

Here rainfall (R) is exogenous variable and not determined within the system i.e. R is not determined by Qs and P. Changes in price and output do not affect the rainfall. Thus, changes in exogenous variable will shift the whole supply curve. In the above discussed Keynesian Macro model investment (I ) has been treated as an exogenous variable which is independent to the level of income.

XI.Equilibrium and Disequilibrium

The concept of equilibrium and disequilibrium are familiar words in physical as well as in social science. The equilibrium is a state of balance between opposing forces or actions and disequilibrium in turn is simply the absence of a state of balance. In case of equilibrium opposing forces bring the variables in equilibrium whereas under disequilibrium opposing forces produce imbalances. In economics, equilibrium is a state in which there is action with repeated nature. This state of equilibrium is maintained, even though the forces acting on the system are in a continuous state of change, as long as the net effect of these changing forces is such as not to disturb the established position of equilibrium.

Let us discuss briefly microeconomic theory and consider the ordinary demand and supply analysis of price determination for a single commodity. The intersection of demand and supply gives a equilibrium price (P) and shift in demand and supply curve brings the change in equilibrium position and the equilibrium price (P').The forces of demand and supply act in such a way that the equilibrium will be attained. These phenomenon is shown in the Figure I – 4.

Figure I – 4: Micro Equilibrium with Demand and Supply.

Macroeconomic model covers thousands of different goods and services supplied and demanded in the markets. We take the aggregate quantity of all these goods and services. Thus in the Figure I -5, AD represents the aggregate demand and AS represents the aggregate supply. The equality of these AD and AS curve gives the equilibrium price level. Any price above and below this equilibrium price gives disequilibrium. At a higher price level there will be excess supply and at a lower price level there will be excess demand. Thus there will be a tendency to move towards equilibrium price level if the price level is below or above the equilibrium level.

Figure I - 5: Macro Equilibrium with Aggregate Demand and Supply.

A.Static and Dynamic Equilibrium

A functional relationship between variables is said to static if the values of the economic variables relate to the same point of time or to the same period of time. The determination of price level by the equality of AD and AS at any point of time is the macro static equilibrium. In the same way equilibrium price determination by the intersection of demand and supply at the point of time is the micro static equilibrium.

On the other hand economic dynamics is the study of economic phenomena in relation to preceding and succeeding events. Dynamic study explicitly recognizes the relevance of time in the process of economic change. What happens in one period is related to what happened in the preceding period and what is expected to happen in the succeeding periods.

In contrasts the variables in static models are pertain to the same period of time, and there is no need to bother with dating. In dynamic models we want to investigate such things like how the amount of goods that businesspersons plan to purchase for inventory may depend on the amount of their sales in a previous period or on the amount of their sales between two previous periods. By this process the dynamic analysis may be able to trace the changes in the values of the variables over time.

Since the static model ignores the passage of time, it is powerless to explain the process of change in a model. It can indicate the position of the model for a given period, but it cannot tell exactly what the position will be in any other period. Pure static analysis is applicable only to a model in which a single, unshifting equilibrium position is established by the relationships among the variables. If there is disequilibrium the static can explain why this is a disequilibrium, what relationship among the variable is necessary for equilibrium and in what direction the system will move. Static equilibrium can not explain the actual process step by step or period by period that the system follows over time in getting to that equilibrium position.

The dynamic method of analysis applies to models in disequilibrium. Dynamics traces the process of change in the values of a model's variables over time. Hence to analyze a model in disequilibrium we must use dynamics. This method shows the system from one point of disequilibrium to another towards an eventual equilibrium position.

B.Comparative Statics

Comparative static compares one equilibrium position to other. It does not analyze the whole path as to how the system grows out from one equilibrium position to another when the data have changed. It merely explains and compares the initial equilibrium position with the final one reached after the system has adjusted to a change in data. Thus, in comparative static analysis, equilibrium positions corresponding to different sets of data are compared.

_________________________________________________________________